Are you ready to take your finances into your own hands? Dive into the world of smart investing with the best micro investing apps today! In this post, we’ll talk about the top five micro investing apps, inspect their fees, and answer key questions surrounding their features.

As a blog writer, I’ve explored various topics to educate and empower my readers. And today, I’m bringing you a topic that hits close to my heart: micro investing apps. I’ve had my fair share of experiences with platforms like Robinhood and E-Trade, and through my journey, I’ve learned a lot about their benefits and potential pitfalls. Our Experience Curator and BWG founder, Candace, has also contributed her valuable insights from more than a decade of using these apps, including her personal experiences and recommendations.

Getting Educated on The 5 Best Micro Investing Apps

Table of Contents

What Are Micro Investing Apps?

Micro investing apps are financial platforms that allow users to invest in stocks, ETFs, and other securities with small amounts of money. As opposed to traditional stock trading platforms which often require sizable investments to get started, micro investing apps enable individuals with limited budgets to participate in the world of investing.

These apps allow you to invest in fractional shares, meaning you can own a portion of a company’s stock with as modest an investment as you can afford. This offers an accessible way for beginners or those without much disposable income to enter the investing world and grow their wealth over time.

Top 5 Best Micro Investing Apps

1. Robinhood

Robinhood is one of the most popular micro investing apps and was my first foray into the world of investment apps. The platform prides itself on offering commission-free trading for stocks, ETFs, options, and cryptocurrencies. Its user-friendly interface makes it easy for beginners to start investing, and advanced investors will appreciate the range of tools available for more complex investment strategies.

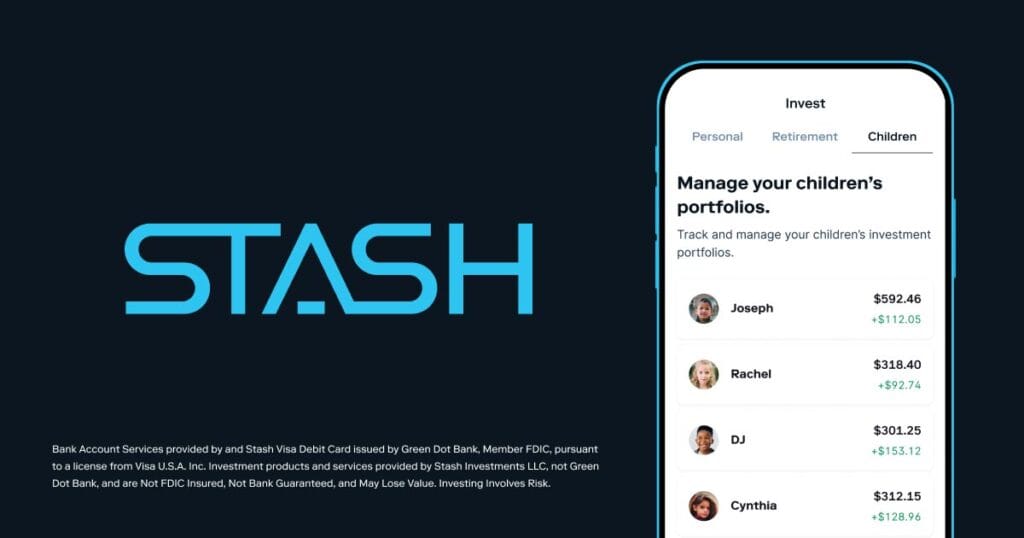

2. Stash

Stash is another app similar to Robinhood, which has a focus on educating its users about personal finance and investing through curated content and investing tips. With Stash, you can invest in individual stocks or ETFs, and create a personalized investment portfolio based on your risk tolerance and financial goals. Although Stash does charge a small fee for its services, it offers a valuable learning resource for those new to investing.

3. Acorns

Acorns is a unique micro investing app that helps users save and invest their spare change. Whenever you make a purchase, Acorns rounds up the amount to the nearest dollar and invests the difference into a diversified portfolio. While the app does involve fees, its automated saving and investing feature makes it an excellent option for those struggling to put money aside for investment purposes.

4. M1 Finance

M1 Finance is similar to Robinhood and Stash, allowing users to invest in individual stocks and ETFs, as well as offering pre-built portfolios called “pies” tailored to specific financial goals. The platform combines automated investing with customizable investment options, making it an excellent choice for investors who want a more hands-off approach.

5. Public

The public provides a social investing experience that allows users to discover new stocks and investment ideas from other users within the app. With Public, you can invest in individual stocks or ETFs and follow what other investors, including experts, are buying and selling. The app offers zero-commission trades and fractional shares, making it an attractive option for investors looking to learn and grow with a community of like-minded individuals.

Related Post: When Building Wealth… Is Micro Investing Worth It?

Answering Key Questions

Is Robinhood micro investing?

Yes, Robinhood can be considered a micro investing app, as it allows users to invest in fractional shares of stocks and ETFs, enabling people to participate in the stock market with minimal funds.

What is a micro-investing app?

A micro investing app is a financial platform that allows users to invest in stocks, ETFs, and other securities with small amounts of money. By enabling investments in fractional shares, these apps make investing accessible for individuals with limited budgets.

Do micro-investing apps have fees?

While some micro investing apps, like Robinhood and Public, offer commission-free trades, others may charge fees for their services. It’s essential to carefully review each app’s fee structure before committing to using the platform.

Sharing the Experience: Anecdotes from Candace, Our Experience Curator

Candace, our Experience Curator and BWG founder, has had a fair share of experiences with micro investing apps, having used them for over a decade. She began her micro investing journey with Robinhood, then moved on to E-Trade, finding both platforms convenient and accessible. It’s essential to learn from those who have already walked the path and avoid their missteps. Therefore, we’re highlighting some of Candace’s experiences and recommendations in this post.

Pay Attention to Fees

Candace emphasized the importance of understanding each app’s fee structure. She admitted to overlooking the fees initially, as she was more focused on the gains and losses of her stocks. Candace discovered that she was paying significant fees for some trades, which affected her overall returns. So, review each app’s fees carefully before committing to it.

Be Cautious with Margin Trading

Margin trading can be risky, and Candace advised exercising caution when trading on margin. Make sure you understand the potential risks and consequences before using this feature on any platform.

Educate Yourself on Options

Options trading can be complex and requires a good understanding of the strategies involved. Candace has yet to delve into options trading, but she’s spent time researching technical analysis to be better prepared. She encourages anyone interested in options trading to do their homework first, especially if you’re new to the micro investing world.

Empowering Black Women: A 7-Day Journey to Personal Empowerment BlackWomanGreat.com is a platform dedicated to supporting black women’s growth worldwide.

As you embark on your financial journey with micro investing apps, don’t forget to pay attention to your overall personal growth. The 7-day audio course, titled “Bloom: A 7-Day Journey to Personal Empowerment,” is an excellent resource to enrich your life in various aspects. At only $7, you’ll invest the equivalent of $1 a day for a week-long journey towards personal empowerment.

Make the Most of Micro Investing Apps: Tips and Tricks

Now that you’re armed with knowledge about the best micro-investing apps and valuable insights from our Experience Curator, Candace, let’s explore some tips and tricks to make the most of these platforms.

Start with Small Consistent Investments

When starting with micro investing, it’s essential to make small, consistent investments instead of jumping in with large sums of money. By doing this, you can gain valuable experience while minimizing your risk. Get into the habit of regularly contributing to your chosen app, and watch your investments grow slowly but surely.

Set Clear Financial Goals

Without clear goals, it’s difficult to measure your success. Before diving into micro-investing, define your financial goals and map out a plan. Do you want to save for a down payment on a house or start a retirement fund? You can tailor your investments accordingly and track your progress by outlining your objectives.

Diversify Your Portfolio

A diverse portfolio is key to reducing risk and maximizing returns. When choosing investments, ensure you spread your funds across various assets, such as stocks, bonds, and ETFs. By doing so, you can mitigate the impact of a single poorly performing investment on your overall portfolio.

Monitor Your Investments and Keep Learning

Regularly monitoring your investments allows you to stay informed about their performance and make adjustments as needed. At the same time, continually seek to educate yourself on investment strategies, market trends, and new opportunities.

Don’t Forget About Taxes

As with any investment, it’s important to be aware of and adequately prepare for taxes on gains from your micro-investments. If you’re using a platform like Robinhood or Public, which do not have tax-loss harvesting features, ensure that you consult with a tax professional to optimize your tax strategy.

Conclusion: Take Charge of Your Wealth With Micro Investing

Micro investing apps have democratized the world of investing, allowing people from all walks of life to take charge of their financial future. Platforms such as Robinhood, Stash, Acorns, M1 Finance, and Public make it easy for individuals with limited budgets to begin their investment journey.

As you dive into the world of micro investing, follow the tips and tricks outlined in this post, learn from Candace’s experiences, and don’t forget to prioritize your personal growth. Invest in yourself with our “Bloom: A 7-Day Journey to Personal Empowerment” audio course, specifically designed to support Black Women in their growth journey. For just $7, you can empower yourself to achieve financial success and personal fulfillment.